OVERVIEW

China PE import prices mostly stable; limited offers due to poor netbacks

SE Asia PE prices largely stable to soft amid stiff price competition

Vietnam price drops continue, outpacing rest of SE Asia

China’s PE import discussions were largely stable in part due to an absence of offers by major overseas suppliers because of unattractive netbacks and with buyers showing limited interest to actively re-stock.

Southeast Asia’s PE import discussions were largely stable to soft as poor downstream finished goods demand continued to plague the market while stiff price competition also persisted among sellers.

In Vietnam, the extreme bearish market sentiment persisted, with losses outpacing the rest of the southeast Asian markets amid ample supply of competitively priced import cargoes.

Scattered offers by some Middle Eastern and southeast Asian producers met resistance with buying indications then coming in well below the initial offer levels.

According to ICIS analysts in the latest forecast report, PE producers are expected to struggle with tight margins for the rest of 2023 with operating rates at some producers likely to be reduced further due to limited ability to pass on higher costs to consumers.

OUTLOOK

Players more likely to wait-and-see on weak demand outlook

SE Asia PE supply may rise further before end of 2023

ICIS analysts forecast PE prices may slip further rest of 2023 with slight gain then seen in Jan 2024

LDPE

SPOT PRICES |

Price Range | Four Weeks Ago | US CTS/lb |

LDPE Film | ||||||

CFR China | USD/tonne | n/c | 950-980 | n/c | 1000-1040 | 43.09-44.45 |

CFR SE Asia All Origins | USD/tonne | n/c | 970-1050 | +10 | 1000-1070 | 44.00-47.63 |

CFR SE Asia Dutiable* | USD/tonne | +20 | 990-1010 | +10 | 1000-1040 | 44.91-45.81 |

CFR SE Asia Non-Dutiable | USD/tonne | n/c | 1020-1050 | +10 | 1020-1070 | 46.27-47.63 |

CFR Vietnam All Origins | USD/tonne | n/c | 970-1010 | n/c | 1000-1070 | 44.00-45.81 |

Click here for the list of deals and discussions for China and here for southeast Asia.

CFR China prices were based on deals.

CFR SE Asia dutiable prices were based on offers in the absence of deals.

CFR SE Asia non-dutiable prices were also assessed on offers in the absence of deals.

CFR Vietnam all-origins prices were assessed on offers at the high end with the low end assessed in line.

LLDPE

SPOT PRICES |

Price Range | Four Weeks Ago | US CTS/lb |

LLDPE Film | ||||||

CFR China | USD/tonne | +5 | 895-930 | n/c | 930-960 | 40.60-42.18 |

CFR SE Asia All Origins | USD/tonne | -20 | 910-1040 | n/c | 980-1050 | 41.28-47.17 |

CFR SE Asia Dutiable* | USD/tonne | n/c | 940-960 | -10 | 980-1010 | 42.64-43.54 |

CFR SE Asia Non-Dutiable | USD/tonne | n/c | 1000-1040 | n/c | 1010-1050 | 45.36-47.17 |

CFR Vietnam All Origins | USD/tonne | -20 | 910-950 | -30 | 980-1010 | 41.28-43.09 |

Click here for the list of deals and discussions for China and here for southeast Asia.

CFR China prices were based on deals.

CFR SE Asia dutiable prices were assessed on deals and offers.

CFR SE Asia non-dutiable prices were assessed stable to reflect limited rangebound offers.

CFR Vietnam all-origins prices were assessed on deals, offers and buying indications.

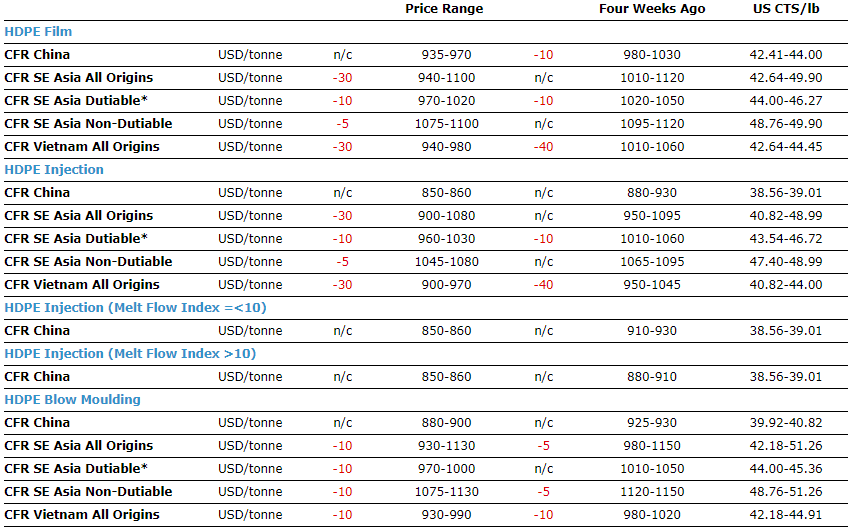

HDPE

SPOT PRICES |

Click here for the list of deals and discussions for southeast Asia.

HDPE FILM

Click here for the list of deals and discussions for China and here for southeast Asia.

CFR China prices were based on deals.

CFR SE Asia dutiable prices were assessed on deals at the low end with the high end assessed in line. The high end also coincided with offers. The range accounted for the bulk of the week’s deals and offers.

CFR SE Asia non-dutiable prices were assessed on deals and offers.

CFR Vietnam all-origins prices were based on deals, offers and buying indications.

HDPE INJECTION

HDPE low-MI and high-MI injection CFR China prices were based on deals at the high ends with the low ends assessed in line.

Dutiable and Non-Dutiable CFR SE Asia HDPE injection prices were assessed in line with Dutiable and Non-Dutiable CFR SE Asia HDPE film prices in limited discussions.

The HDPE injection CFR Vietnam all-origins prices were assessed in line with HDPE film CFR Vietnam prices in limited price discussions.

HDPE BLOW MOULDING

CFR China prices were based on deals.

Dutiable CFR SE Asia HDPE blow moulding prices were assessed on offers.

Non-dutiable CFR SE Asia HDPE blow moulding prices were assessed on deals and offers.

HDPE blow moulding CFR Vietnam all-origins prices were assessed on offers at the low end with the high end assessed in line.

OTHER REGIONS

PRODUCTION

Blue: expected capacity Green: online Orange: scheduled shutdown Red: unscheduled shutdown

Click here for the ICIS Live Supply Disruption Tracker.

UPSTREAM

Click here for the Asia feedstocks and petrochemicals weekly summary

Ethylene vs SE Asia LLDPE price spread narrowed further this week, suggesting further pressure on producer margins

Ethylene vs NE Asia LLDPE price spread stayed below the threshold level

Feedstock Spread – Ethylene and LLDPE SE Asia

Feedstock Spread – Ethylene and LLDPE NE Asia

FEEDSTOCK SPOT PRICES |

Price Range | Four Weeks Ago |

Ethylene | |||||

CFR NE Asia | USD/tonne | +10 | 870-885 | n/c | 870-900 |

Polyethylene (Asia-Pacific) | 03-Nov-2023. ICIS accepts no liability for commercial decisions based on the content of this report. Unauthorised reproduction, onward transmission or copying of the Polyethylene (Asia-Pacific) Report in either its electronic or hard copy format is illegal. Should you require a licence or an additional copy of the Polyethylene (Asia-Pacific)